Goldman Sachs sees oil prices sliding through 2026

Robert Besser

18 Apr 2025, 15:18 GMT+10

- Goldman Sachs has signaled a prolonged downturn in oil prices, forecasting a steady decline through the end of 2026 due to weak global demand and rising output from oil-producing nations

- The Wall Street bank said it expects Brent crude to average U$63 a barrel for the rest of 2025, falling to $58 in 2026. West Texas Intermediate (WTI) is projected to drop to $59 this year and further to $55 next year

- In a research note issued over the weekend, Goldman cited the escalating U.S.-China trade war and the growing risk of recession as key drivers behind its forecast

New York City: New York: Goldman Sachs has signaled a prolonged downturn in oil prices, forecasting a steady decline through the end of 2026 due to weak global demand and rising output from oil-producing nations.

The Wall Street bank said it expects Brent crude to average U$63 a barrel for the rest of 2025, falling to $58 in 2026. West Texas Intermediate (WTI) is projected to drop to $59 this year and further to $55 next year.

In a research note issued over the weekend, Goldman cited the escalating U.S.-China trade war and the growing risk of recession as key drivers behind its forecast. The firm slashed its global oil demand growth projections for the fourth quarter of 2026 by 900,000 barrels per day (bpd) since mid-March, citing deteriorating macroeconomic conditions.

"Given the weak growth outlook amid a global trade war," Goldman said, "we now expect oil demand to rise by only 300,000 bpd between the end of last year and the end of 2025."

Last week, Beijing raised tariffs on U.S. goods to 125% in response to President Donald Trump's decision to sharply increase duties on Chinese imports—deepening a standoff that has already roiled global markets.

Despite the oil market already pricing in some future inventory builds, Goldman sees large surpluses of 800,000 bpd in 2025 and 1.4 million bpd in 2026 continuing to weigh on prices.

The bank also outlined a more severe downside scenario in which either a global slowdown deepens or the 2.2 million bpd in voluntary output cuts by OPEC+ are fully reversed. In such cases, Brent could fall into the $40 range by 2026—and potentially drop below $40 in an extreme scenario.

As of early this week in Asia, Brent crude futures had slipped to around $64.72 a barrel, while WTI was trading at $61.44.

Goldman also lowered its U.S. shale supply estimate for Q4 2026 by 500,000 bpd, further underscoring expectations of a market flush with supply but lacking the demand to support current price levels.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Cleveland Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Cleveland Star.

More InformationBusiness

SectionGoldman Sachs sees oil prices sliding through 2026

New York City: New York: Goldman Sachs has signaled a prolonged downturn in oil prices, forecasting a steady decline through the end...

U.S. stocks end trading week mixed as investors break for Easter

NEW YORK, New York - U.S. stocks were volatile again Friday as President Donald Trump blasted Federal Reserve chair Jerome Powell for...

Eurozone drops official interest rates by quarter-percent

BRUSSELS, Belgium - The Europesn Central Bank has slashed official interest rates in the wake of the financial crisis triggered by...

Feds order safety fixes after Keystone oil spill in North Dakota

BISMARCK, North Dakota: Federal officials have ordered the company running the Keystone Pipeline to take several safety steps after...

US tariffs put pressure on India’s shrimp exports

GANAPAVARAM, India/GUAYAQUIL, Ecuador: India's shrimp exporters are facing mounting uncertainty as new U.S. tariffs threaten to disrupt...

U.S. stocks, dollar continue to be crushed by Trump tariiffs

NEW YORK, New York - Technology stocks fell sharply Wednesday, dragging down the industrial sector in its wake, as Donald Trump's trade...

Ohio

SectionGM to press pause on EV van production in Ontario

DETROIT, Michigan: General Motors is hitting pause on production of its BrightDrop electric vans in Ontario, Canda, citing the need...

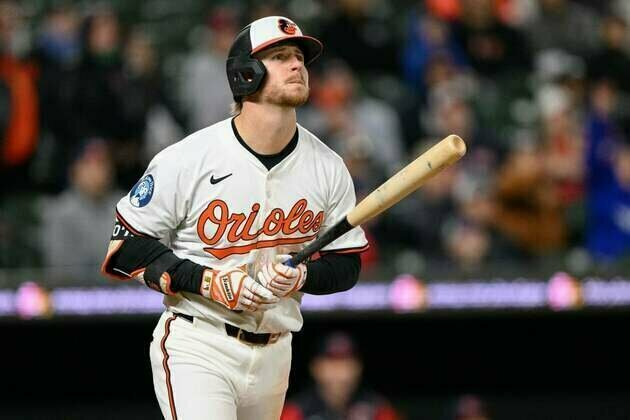

Finally on win streak, Orioles welcome Reds to town

(Photo credit: Reggie Hildred-Imagn Images) The Baltimore Orioles will carry some rare momentum into their next series, a three-game...

Jays search for way to slow Mariners' Cal Raleigh

(Photo credit: Katie Stratman-Imagn Images) The Toronto Blue Jays will face an old nemesis, catcher Cal Raleigh, when they host the...

Luis L. Ortiz opposes former team as Guardians visit Pirates

(Photo credit: David Richard-Imagn Images) Fresh off one of the best starts of his career, Cleveland right-hander Luis L. Ortiz will...

MLB roundup: Kumar Rocker gets first career win for streaking Rangers

(Photo credit: Jim Cowsert-Imagn Images) Kumar Rocker put together a solid outing to earn his first career win as the Texas Rangers...

O's belt 3 HRs, clinch series win over Guardians

(Photo credit: James A. Pittman-Imagn Images) Ryan O'Hearn belted a go-ahead three-run home run in the third inning of Baltimore's...