Lumbee Guaranty Bank Reports 1st Quarter 2022 Earnings

ACCESS Newswire

09 May 2022, 19:31 GMT+10

Company reports consistent quarterly earnings, asset growth, and continued improvement in asset quality

- $1.06 million in net income for the quarter-ended March 31, 2022.

- 11.4% asset growth, driven by a 13.4% increase in deposits.

- Improving asset quality led to a credit for loan losses.

PEMBROKE, NC / ACCESSWIRE / May 9, 2022 / For the quarter ended March 31, 2022, Lumbee Guaranty Bank ('Lumbee' or 'Bank'), reported net income of $1,057,000, or earnings per share of $0.32, compared to net income of $1,062,000, or earnings per share of $0.31, for the same period in 2021. As of the quarter-end, Lumbee reported assets of $486.4 million, an increase of 11.4% over assets of $436.4 million as of March 31, 2021. Loans decreased 12.0% to $175.7 million, compared to loans of $199.6 million reported March 31, 2021. Deposits grew to $438.6 million at March 31, 2022, an increase of 13.4% from March 31, 2021 deposits of $386.6 million. Capital levels remained strong, as shareholders' equity totaled $38.8 million, or 8.0% of assets at March 31, 2022, versus $42.7 million, or 9.8% of assets at the year-ago date. The decrease in shareholders' equity was due to unrealized losses in the available-for-sale securities portfolio.

Net interest income remained steady with $3.35 million in the first quarter of 2022, down 1.15% from $3.39 million in the year-ago quarter. The stability of the interest income was due to a decrease in Paycheck Protection Program fees offset by an increase in interest on investments during the first quarter of 2022.

As asset quality continues to improve, the Bank was able to recognize a credit of $88 thousand in the quarter ending March 31, 2022, compared to no provision in 2021's first quarter. Nonperforming assets ('NPAs') at March 31, 2022, (including nonaccruing loans, loans more than 90 days past due and still accruing, and OREO) were $2.06 million, or 0.42% of total assets, which was down 0.96% from $2.1 million, or 0.44% of total assets, at December 31, 2021, and down 52.09% from $4.3 million, or 0.98% of total assets, at March 31, 2021. The allowance for loan losses was $1.96 million, or 1.11% of gross loans, at March 31, 2022, versus $2.36 million, or 1.17% of gross loans, at the year-ago date.

Noninterest income increased by 3.55% from $592 thousand in the quarter ending March 31, 2021 to $613 thousand at quarter-end due to increased service charges on deposit accounts. Noninterest expense was $2.78 million in the first quarter of 2022, up 1.76% from $2.73 million in the year-ago quarter. The increased expenses were due to a combination of increased personnel costs and other expenses.

'Our Bank had a solid performance the first quarter of 2022' said Kyle R. Chavis, Chief Executive Officer of Lumbee. 'Core earnings beat projections, with pretax income (excluding non-recurring items) showing an 18% increase. We continue to benefit from the growth in our earning assets and improving asset quality.' Chavis continued, 'Management continues to monitor the rising interest rate environment, as well as inflationary pressures, and we will maintain our focus on meeting the financial needs of the markets we serve.'

Lumbee Guaranty Bank is a community bank headquartered in Pembroke, NC and serves Robeson, Cumberland, and Hoke Counties. Established in 1971, the Bank offers a full array of financial services through its network of fourteen strategically located branch offices over the three-county area. The Bank's common stock is traded on the OTC-QX under the stock symbol LUMB.

The information as of and for the quarter ended March 31, 2022, as presented is unaudited. This news release contains forward-looking statements. Actual results may differ materially from those projected, for various reasons, including our ability to manage growth, our limited operating history, substantial changes in financial markets, regulatory changes, changes in interest rates, loss of deposits and loan demand to other savings and financial institutions, and changes in real estate values and the real estate market.

CONTACT:

Kyle R. Chavis, Chief Executive Officer

Lumbee Guaranty Bank

(910) 521-9707; [email protected];

www.lumbeeguarantybank.com

SOURCE: Lumbee Guaranty Bank

View source version on accesswire.com:

https://www.accesswire.com/700601/Lumbee-Guaranty-Bank-Reports-1st-Quarter-2022-Earnings

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Cleveland Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Cleveland Star.

More InformationBusiness

SectionMusk’s X loses CEO Linda Yaccarino amid AI backlash, ad woes

BASTROP, Texas: In a surprising turn at Elon Musk's X platform, CEO Linda Yaccarino announced she is stepping down, just months after...

Ex-UK PM Sunak takes advisory role at Goldman Sachs

NEW YORK CITY, New York: Former British prime minister Rishi Sunak will return to Goldman Sachs in an advisory role, the Wall Street...

Gold ETF inflows hit 5-year high as tariffs drive safe-haven bets

LONDON, U.K.: Physically backed gold exchange-traded funds recorded their most significant semi-annual inflow since the first half...

PwC: Copper shortages may disrupt 32 percent of chip output by 2035

AMSTERDAM, Netherlands: Some 32 percent of global semiconductor production could face climate change-related copper supply disruptions...

U.S. stocks recover after Trump-tariffs-induced slump

NEW YORK, New York - U.S. stocks rebounded Tuesday with all the major indices gaining ground. Markets in the UK, Europe and Canada...

Stocks slide as Trump unveils 25% tariffs on Japan, S. Korea

NEW YORK CITY, New York: Financial markets kicked off the week on a cautious note as President Donald Trump rolled out a fresh round...

Ohio

SectionRubio impersonator used AI to reach officials via Signal: cable

WASHINGTON, D.C.: An elaborate impersonation scheme involving artificial intelligence targeted senior U.S. and foreign officials in...

Reds look to continue making history as they open series vs. Rockies

(Photo credit: Brad Mills-Imagn Images) The Cincinnati Reds need just one win this weekend to continue a unique pursuit of history...

White Sox, Guardians ready for split doubleheader after postponement

(Photo credit: Kamil Krzaczynski-Imagn Images) Kyle Manzardo was slated to bat cleanup and play first base for the Cleveland Guardians...

Orioles look to stay hot vs. Marlins

(Photo credit: Jerome Miron-Imagn Images) The Miami Marlins and Baltimore Orioles have been counted out for much of the past couple...

Minus goalie Stefan Frei, Sounders to take on Sporting KC

(Photo credit: Alex Gallardo-Imagn Images) The Seattle Sounders will be without their captain when they travel to Kansas City, Kan....

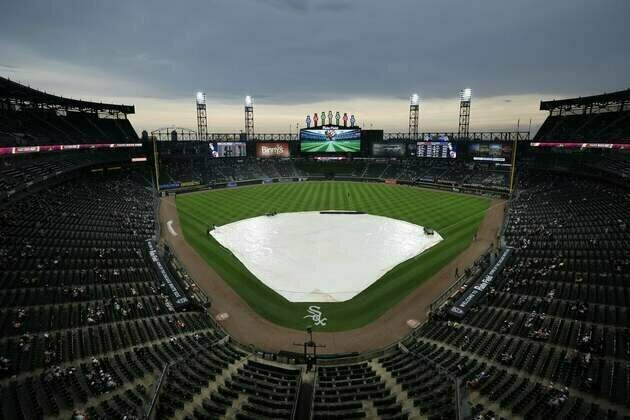

White Sox home game vs. Guardians rescheduled due to rain

(Photo credit: Kamil Krzaczynski-Imagn Images) Thursday evening's contest between the host Chicago White Sox and Cleveland Guardians...