Skeena Delivers Robust Project Economics for Eskay Creek: After-Tax NPV5% of C$638M, 51% IRR and 1.2 Year Payback

ACCESS Newswire

07 Nov 2019, 18:31 GMT+10

VANCOUVER, BC / ACCESSWIRE / November 7, 2019 / Skeena Resources Limited (TSX.V:SKE) (OTCQX:SKREF) ('Skeena' or the 'Company') is pleased to announce the initial Preliminary Economic Assessment ('PEA') completed by Ausenco Engineering Canada Inc. ('Ausenco'), supported by SRK Consulting (Canada), and AGP Mining Consultants, for the Eskay Creek gold-silver project ('Eskay Creek' or the 'Project') located in the Golden Triangle of British Columbia.

Eskay Creek 2019 PEA Highlights:

- High-grade open-pit averaging 3.23 g/t Au, 78 g/t Ag (4.17 g/t AuEq) (diluted)

- After-tax NPV5% of C$638M (US$491M) and 51% IRR at US$1,325/oz Au and US$16/oz Ag

- After-tax payback period of 1.2 years

- Pre-production capital expenditures (CAPEX) of C$303M (US$233M)

- After-tax NPV:CAPEX Ratio of 2.1:1

- Life of mine ('LOM') average annual production of 236,000 oz Au, 5,812,000 oz Ag (306,000 oz AuEq)

- LOM all-in sustaining costs (AISC) of C$983/oz (US$757/oz) AuEq recovered

- LOM cash costs of C$949/oz (US$731/oz) AuEq recovered

- 6,850 tonne per day (TPD) mill and flotation plant producing saleable concentrate

1. Exchange Rate (US$/C$) of 0.77

2. Cash costs are inclusive of mining costs, processing costs, site G&A, treatment and refining charges and royalties

3. AISC includes cash costs plus estimated corporate G&A, sustaining capital and closure costs

4. Gold Equivalent (AuEq) calculated via the formula: Au (g/t) + [Ag (g/t) / 82.8]

Skeena's CEO, Walter Coles commented, 'Eskay Creek was a remarkable discovery that became an extraordinary underground mine in 1994 and produced until 2008. This PEA demonstrates that Eskay Creek still has a bright future ahead, revitalized as an open-pit gold and silver mine, with the additional possibility for underground mining. The Project has the potential to produce an average of 306,000 gold-equivalent ounces per year with a diluted mill feed grade of 4.17 grams per tonne gold-equivalent. Also, as a brownfield site, Eskay Creek benefits from tremendous infrastructure installed by the previous operators. Finally, by creating a gold concentrate rather than doré, we are able to keep initial capital costs very low, at US$233 million, relative to the amount of precious metals produced; this also simplifies and reduces technical risks for the Project.'

PEA Overview

The 2019 Eskay Creek PEA considers an open-pit mine with on-site treatment of the mined material by conventional milling and flotation to recover a gold-silver concentrate for provision to third-party smelters. The mine will be an owner-operated, standard truck and shovel open-pit, with a leased mining fleet. At present, no contributions from previously reported underground resources are incorporated into this study. The processing capacity of 6,850 tonnes per day will result in a production lifespan of 8.6 years. An additional 1.5 years of pre-stripping, stockpiling and mine access development is planned prior to the processing facility becoming fully operational in Year 1. The PEA leverages Eskay Creek's extensive existing infrastructure, including all-weather access roads, previously permitted tailing storage facilities (TSF) and proximity to the recently commissioned 195 MW hydroelectric facilities and linked power grid.

The PEA is derived from the Company's pit-constrained resource estimate (February 28, 2019), and does not include results from the recently initiated and ongoing 2019 Phase I infill drilling program. The effective date of the PEA is November 7, 2019 and a technical report will be filed on the Company's website and SEDAR within 45 days of this disclosure.

Mineral resources are not mineral reserves and do not have demonstrated economic viability. The PEA is preliminary in nature and includes inferred mineral resources that are too speculative to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that PEA results will be realized.

Table 1: 2019 Eskay Creek 2019 PEA Detailed Parameters and Outputs

Assumptions | |

Gold Price (US$) | $1,325 |

Silver Price (US$) | $16 |

Exchange Rate (US$/C$) | 0.77 |

Discount Rate | 5% |

Royalties | 1% |

Contained Metals | |

Contained Gold Ounces (koz) | 2,212 |

Contained Silver Ounces (koz) | 53,404 |

Contained AuEq Ounces (koz) | 2,857 |

Mining | |

Mine Life (Years) | 8.6 |

Strip Ratio (Waste:Mineralization) | 7.2:1 |

Total Tonnage Mined (t) | 175,270 |

Total Mineralized Material Mined (t) | 21,307 |

Processing | |

Processing Throughput (TPD) | 6,850 |

Average Diluted Gold Grade (g/t) | 3.23 |

Average Diluted Silver Grade (g/t) | 78 |

Average Diluted Gold Equivalent Grade (g/t) | 4.17 |

Production | |

Gold Recovery | 91.1% |

Silver Recovery | 92.4% |

LOM Gold Production (koz) | 2,022 |

LOM Silver Production (koz) | 49,872 |

LOM Gold Equivalent Production (koz) | 2,624 |

LOM Average Annual Gold Production (koz) | 236 |

LOM Average Annual Silver Production (koz) | 5,812 |

LOM Average Annual Gold Equivalent Production (koz) | 306 |

Operating Costs | |

Mining Cost (C$/t Mined) | $3.44 |

Mining Cost (C$/t Milled) | $26.32 |

Processing Cost (C$/t Milled) | $21.64 |

G&A Cost (C$/t Milled) | $6.06 |

Total Operating Cost (C$/t Milled) | $54.03 |

Cash Costs and AISC | |

LOM Cash Cost (US$/oz Au) Net of Silver By-Product | $582 |

LOM Cash Cost (US$/oz AuEq) Co-Product | $731 |

LOM AISC (US$/oz Au) Net of Silver By-Product | $615 |

LOM AISC (US$/oz AuEq) Co-Product | $757 |

Capital Expenditures | |

Pre-Production Capital Expenditures (C$M) | $303 |

Sustaining Capital Expenditures (C$M) | $27 |

Reclamation Cost (C$M) | $52 |

Economics | |

After-Tax NPV (5%) (C$M) | $638 |

After-Tax IRR | 51% |

After-Tax Payback Period (Years) | 1.2 |

After-Tax NPV:CAPEX Ratio | 2.1:1 |

Pre-Tax NPV (5%) (C$M) | $993 |

Pre-Tax IRR | 63% |

Pre-Tax Payback Period (Years) | 1.1 |

Pre-Tax NPV:CAPEX Ratio | 3.3:1 |

Average Annual After-Tax Free Cash Flow (Year 1-9) (C$M) | $147 |

LOM After-Tax Free Cash Flow (C$M) | $959 |

1. Cash costs are inclusive of mining costs, processing costs, site G&A, treatment and refining charges and royalties

2. AISC includes cash costs plus corporate G&A, sustaining capital and closure costs

3. Gold Equivalent (AuEq) calculated via the formula: Au (g/t) + [Ag (g/t) / 82.8]

Sensitivities

After-tax economic sensitivities to commodity prices are presented in Table 2 illustrating the effects of varying gold and silver prices as compared to the base-case. Additional Project sensitivities will be presented in the Technical Report.

Table 2: After-Tax NPV (5%) and IRR Sensitivities to Commodity Prices

Lower Case | Base Case | Higher Case | |

Gold Price (US$/oz) | $1,200 | $1,325 | $1,500 |

Silver Price (US$/oz) | $14 | $16 | $18 |

After-Tax NPV (5%) (C$M) | $453 | $638 | $878 |

After-Tax IRR (%) | 40% | 51% | 63% |

After-Tax Payback (Years) | 1.6 | 1.2 | 0.9 |

Average Annual After-Tax Free Cash Flow (Years 1-9) (C$M) | $117 | $147 | $187 |

Eskay Creek Mineral Resource Estimate

The Company's current Mineral Resource Estimate (MRE; effective date of February 28, 2019) completed by SRK Consulting (Canada) forms the basis for this PEA. The MRE does not include drilling results from the Company's recently initiated and ongoing 2019 Phase I infill program.

Table 3: Pit constrained Mineral Resource Statement reported at 0.7 g/t AuEq cut-off:

| Grade | Contained Ounces | |||||

| Tonnes | AuEq | Au | Ag | AuEq | Au | Ag |

| (000) | g/t | g/t | g/t | oz (000) | oz (000) | oz (000) |

Total Indicated | 12,650 | 5.8 | 4.3 | 110 | 2,340 | 1,740 | 44,660 |

Total Inferred | 14,420 | 2.9 | 2.3 | 47 | 1,340 | 1,050 | 21,720 |

Table 4: Underground Mineral Resource Statement reported at a 5.0 g/t AuEq cut-off:

| Grade | Contained Ounces | |||||

| Tonnes | AuEq | Au | Ag | AuEq | Au | Ag

Shares

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

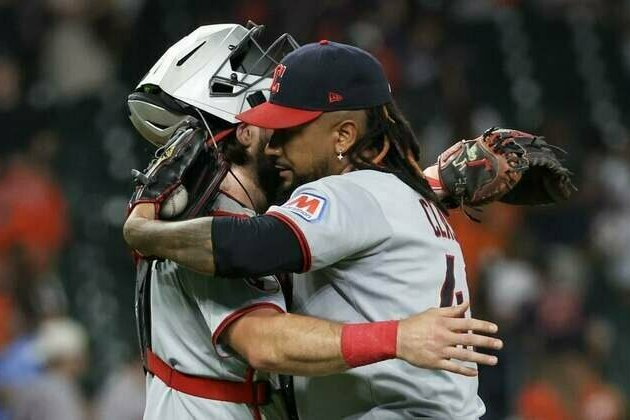

Watch latest videosSubscribe and FollowGet a daily dose of Cleveland Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well. News RELEASESPublish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Cleveland Star. More Information

null in null

BusinessSectionBirkenstock steps up legal battle over fakes in IndiaNEW DELHI, India: Birkenstock is stepping up its efforts to protect its iconic sandals in India, as local legal representatives conducted... Beijing hits back at EU with medical device import curbsHONG KONG: China has fired back at the European Union in an escalating trade dispute by imposing new restrictions on medical device... Wall Street reels after Trump invokes new tariffsNEW YORK, New York - Monday's trading session saw mixed performances across U.S. and global markets, with several major indices posting... Trump admin allows GE to restart engine sales to China’s COMACWASHINGTON, D.C.: The U.S. government has granted GE Aerospace permission to resume jet engine shipments to China's COMAC, a person... Saudi Aramco plans asset sales to raise billions, say sourcesDUBAI, U.A.E.: Saudi Aramco is exploring asset sales as part of a broader push to unlock capital, with gas-fired power plants among... Russia among 4 systemic risk countries for Italian banksMILAN, Italy: Italian regulators have flagged four non-EU countries—including Russia—as carrying systemic financial risk for domestic... OhioSectionHot-hitting Red Sox hope to continue feasting on Rockies(Photo credit: Paul Rutherford-Imagn Images) The Boston Red Sox are facing a light portion of their schedule and taking advantage... MLB roundup: Guardians top Astros to halt 10-game skid(Photo credit: Thomas Shea-Imagn Images) Brayan Rocchio lined a go-ahead, two-run double into the left field corner with two outs... Marlins pitchers stifle struggling Reds bats in series opener(Photo credit: Joe Camporeale-Imagn Images) Janson Junk held the Cincinnati Reds to one hit over six innings and Agustin Ramirez... Guardians snap 10-game skid in win at Astros(Photo credit: Thomas Shea-Imagn Images) Brayan Rocchio lined a go-ahead, two-run double into the left-field corner with two outs... All-Star Byron Buxton guides Twins against high-powered Cubs(Photo credit: Bruce Kluckhohn-Imagn Images) Byron Buxton has solidified his status as a two-time All-Star for the Minnesota Twins.... Hawks officially bring in F/C Kristaps Porzingis, waive F David Roddy(Photo credit: Matt Marton-Imagn Images) The Atlanta Hawks officially welcomed Kristaps Porzingis on Monday while waiving forward... Movie Review |